Master Any Country's Tax Math With One Simple Formula

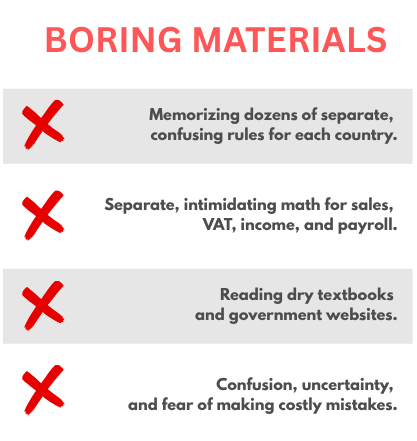

Stop memorizing confusing rules. Our guide reveals the universal shortcut to calculating tax on sales and paychecks in Japan, the U.S., and the Philippines.

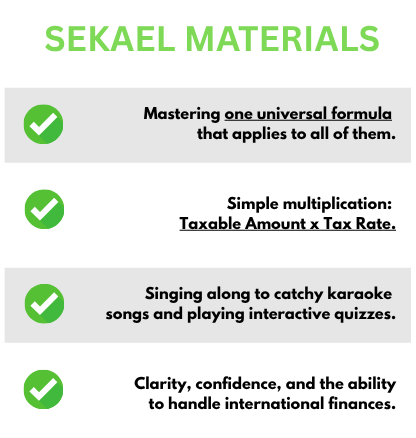

Here's Exactly What You'll Get.

Master the Basics

Test Your Terms

Do the Math

Sing to Learn

Do International Tax Rules Make Your Head Spin?

Imagine Handling International Taxes with Total Confidence and Simplicity

INTRODUCING

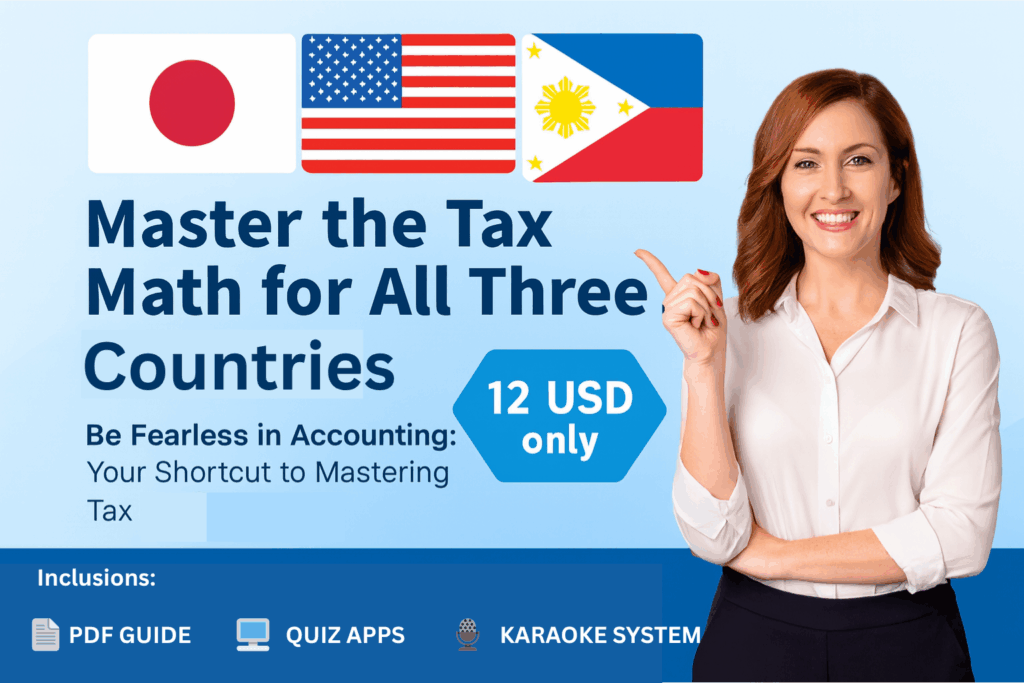

Be Fearless in Accounting:

Your

Shortcut to Mastering Tax by SEKAEL

- The ultimate guide for freelancers and creatives who need to navigate the tax systems of Japan, the U.S., and the Philippines without the headache.

-

- A unique system that throws out the complicated rulebook and reveals the one core formula that governs nearly all tax math.

-

- A fun, interactive tool designed to make tax calculations feel simple, intuitive, and stress-free.

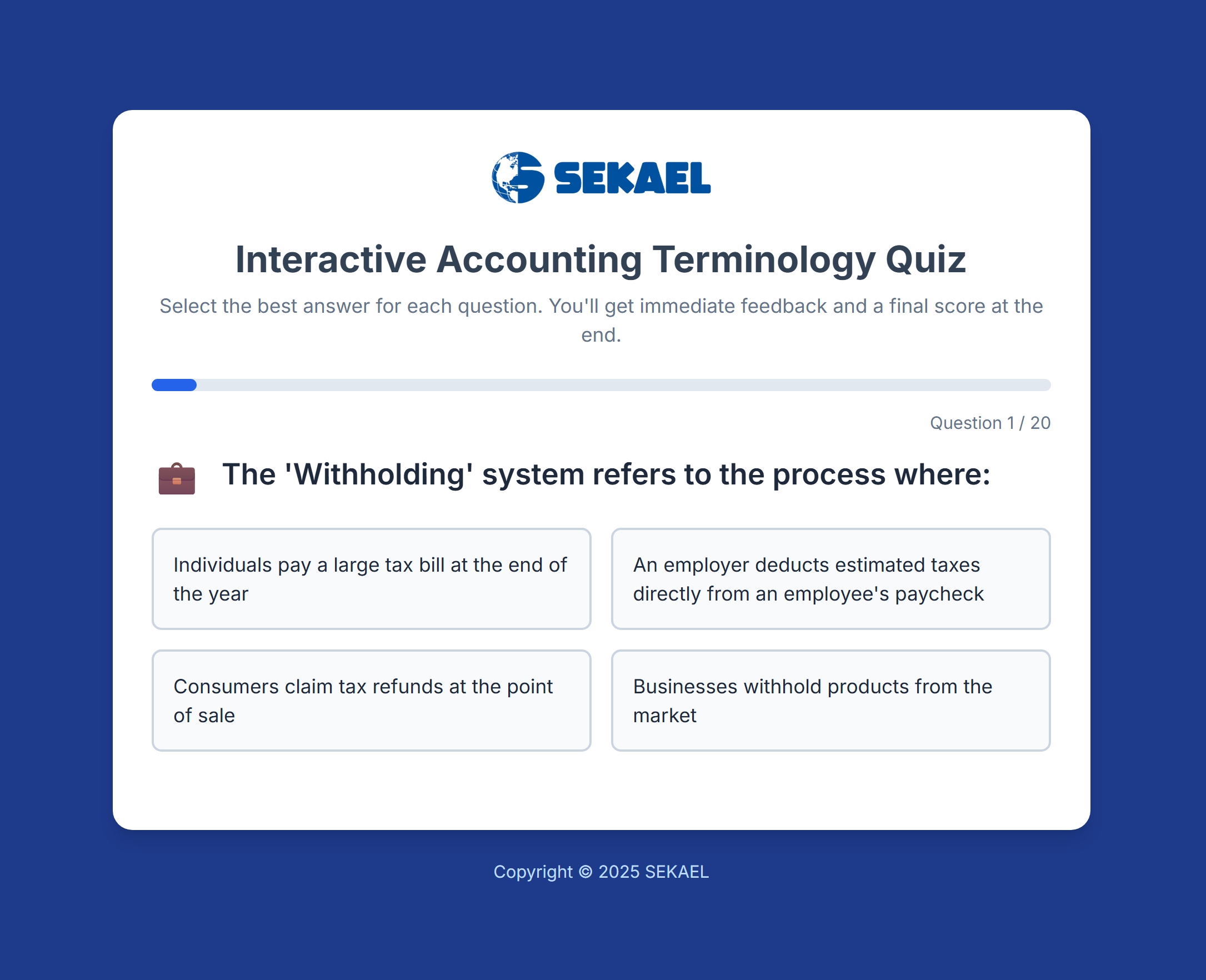

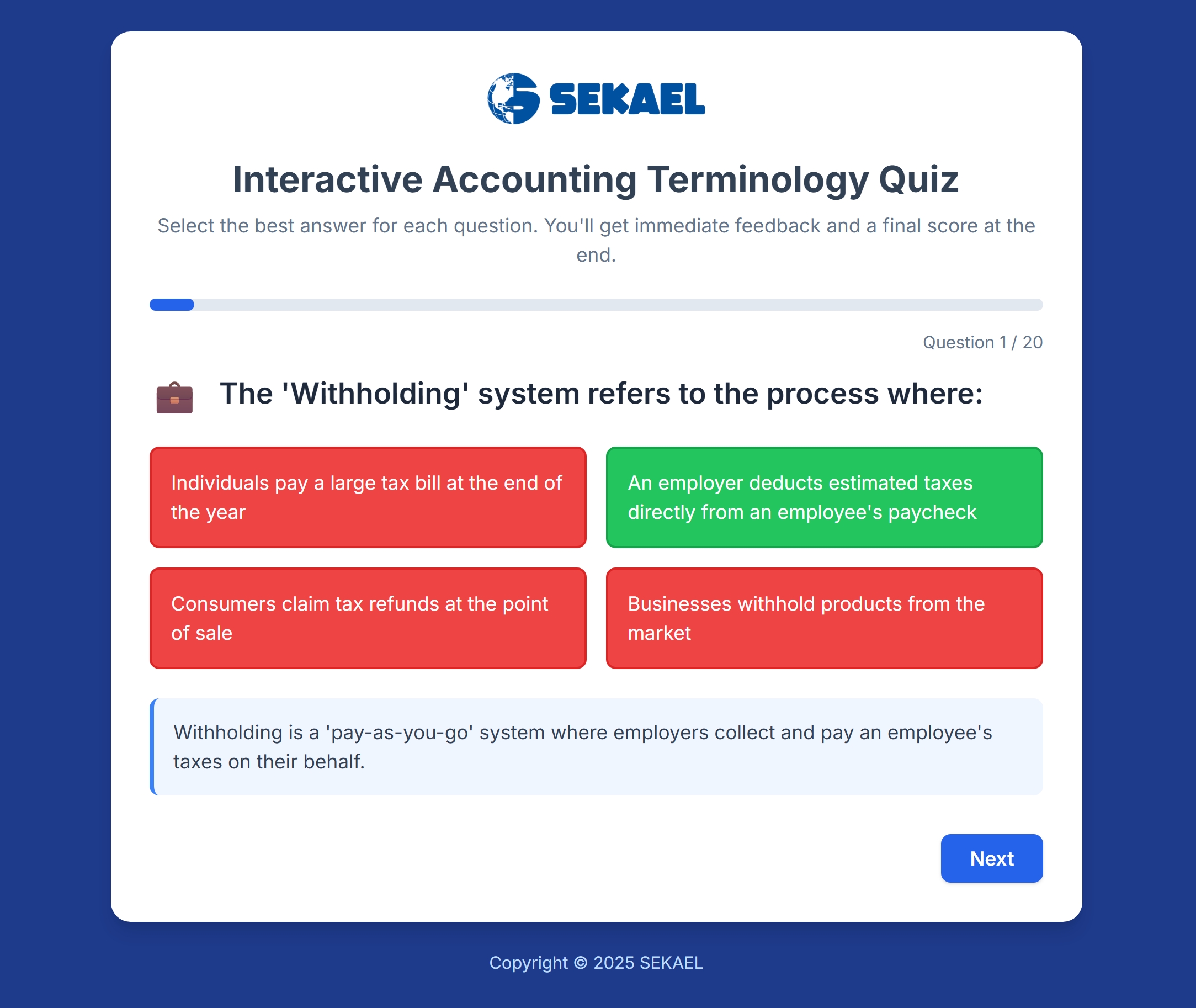

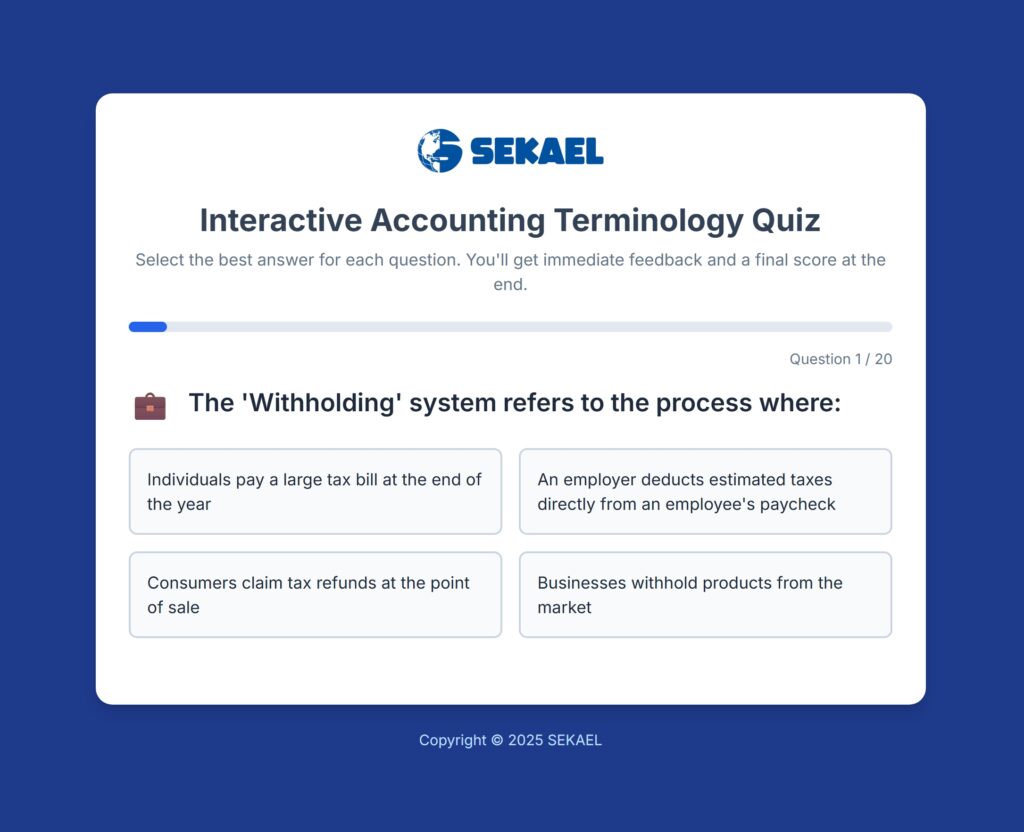

Interactive Accounting Terminology Quiz

What it is: A 20-question interactive quiz that tests your knowledge of key tax terminology across the three countries.

Unique point: Get immediate feedback and detailed explanations for every question, ensuring you truly understand terms like “Progressive Tax,” “VAT Inclusive,” and “FICA.”

Advantages: Actively test your vocabulary in a fun, no-pressure environment so you can speak about taxes with confidence.

What you’ll learn: You’ll solidify your understanding of 20 core tax terms, from the three main categories of taxes to the specific systems used in Japan, the U.S., and the Philippines.

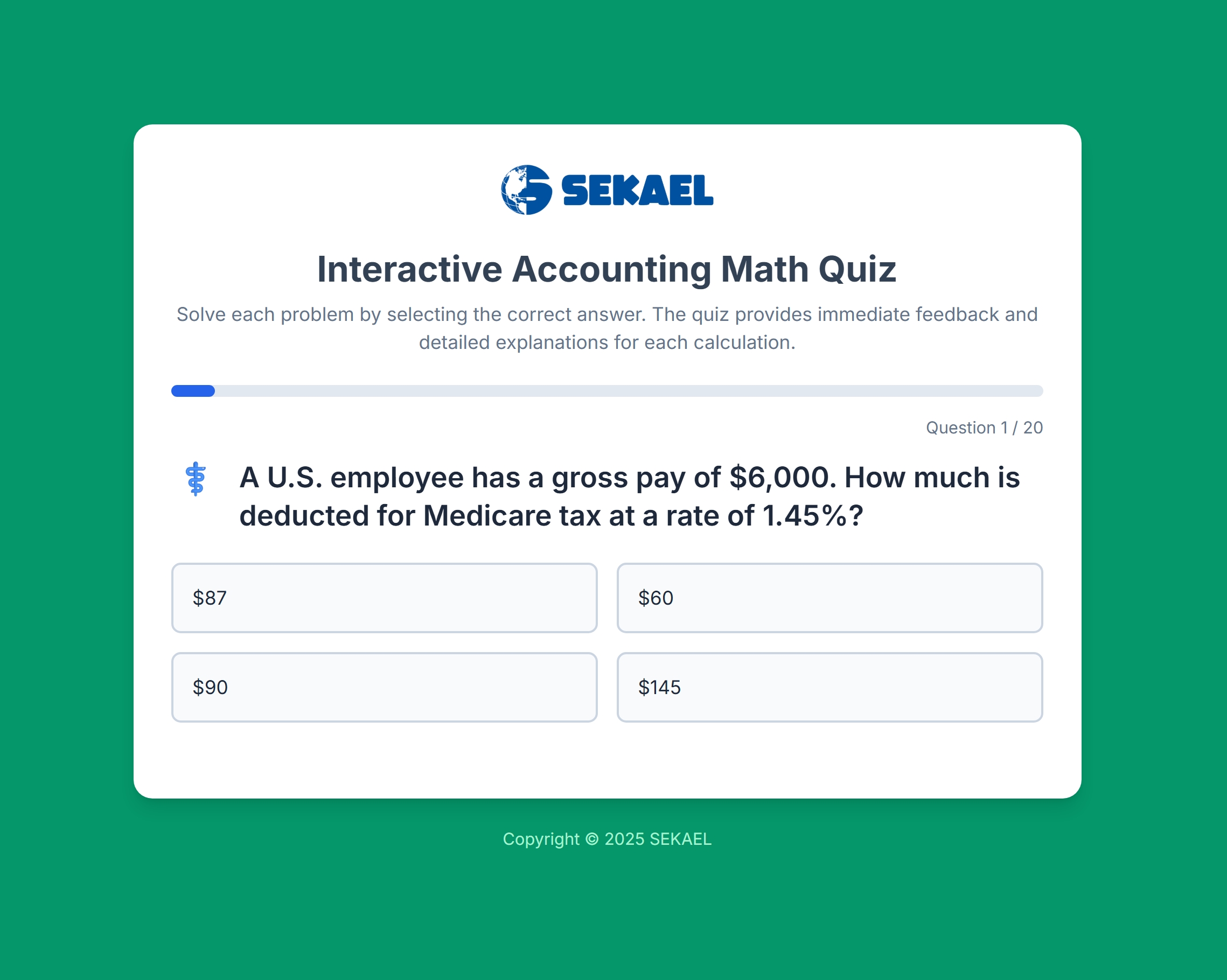

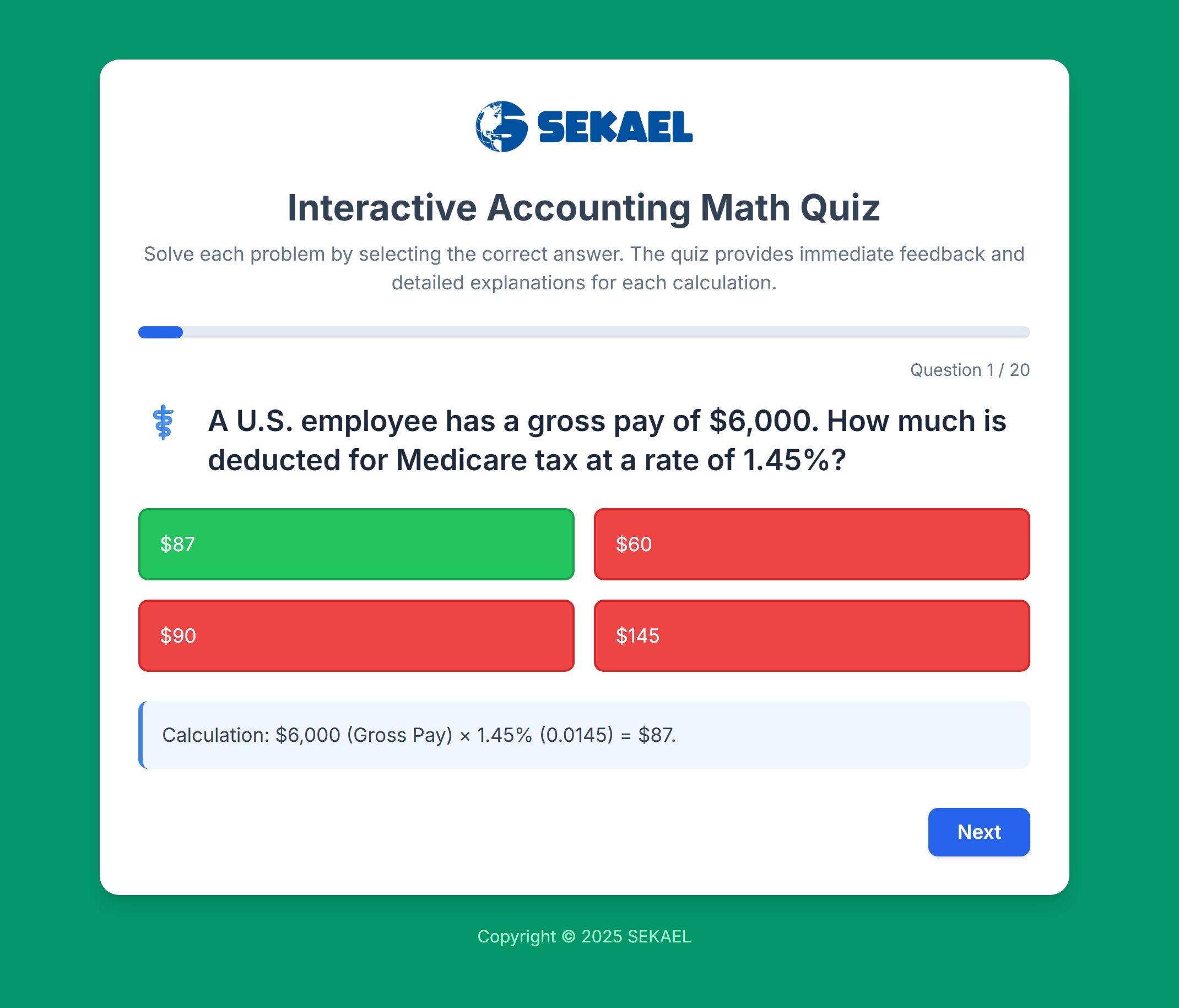

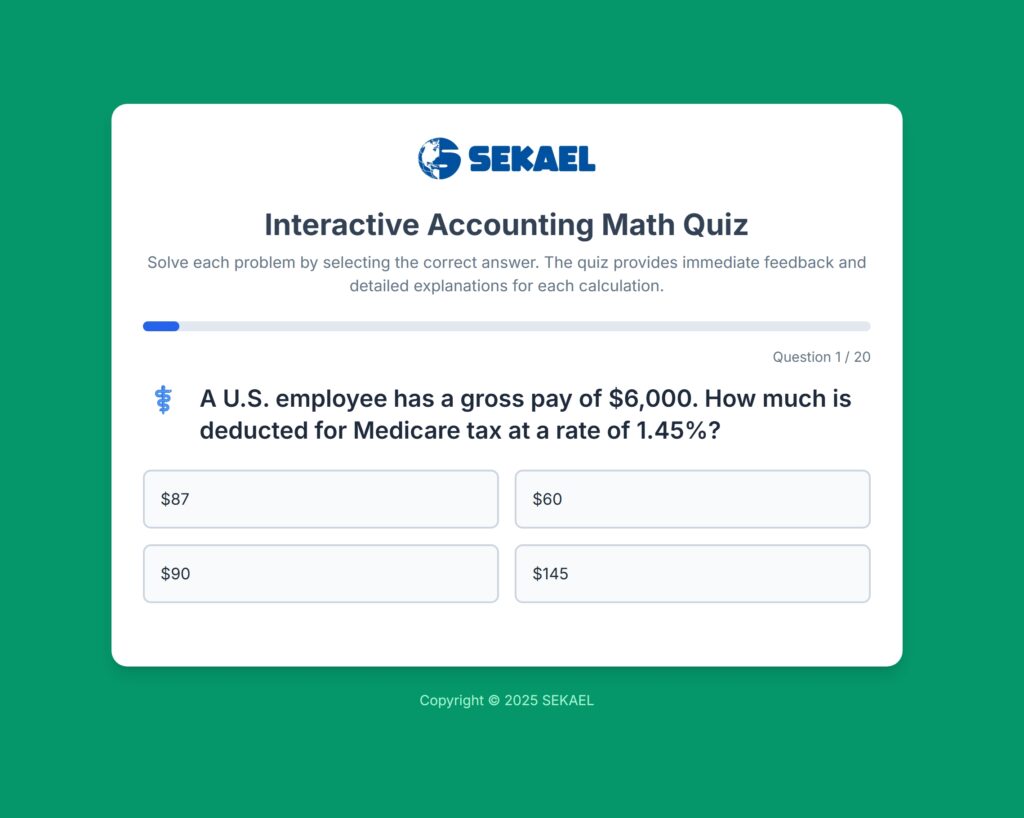

Interactive Accounting Math Quiz

What it is: A 20-question interactive quiz focused entirely on applying the universal tax formula to real-world problems.

Unique point: Features practical scenarios from the PDF, allowing you to calculate everything from Social Security deductions in the U.S. to the VAT on a bill in the Philippines.

Advantages: Build your calculation speed and confidence in a hands-on environment, complete with step-by-step explanations for every problem.

What you’ll learn: You will master applying the “Taxable Amount x Rate” formula to 20 different real-world scenarios, covering both sales and payroll taxes.

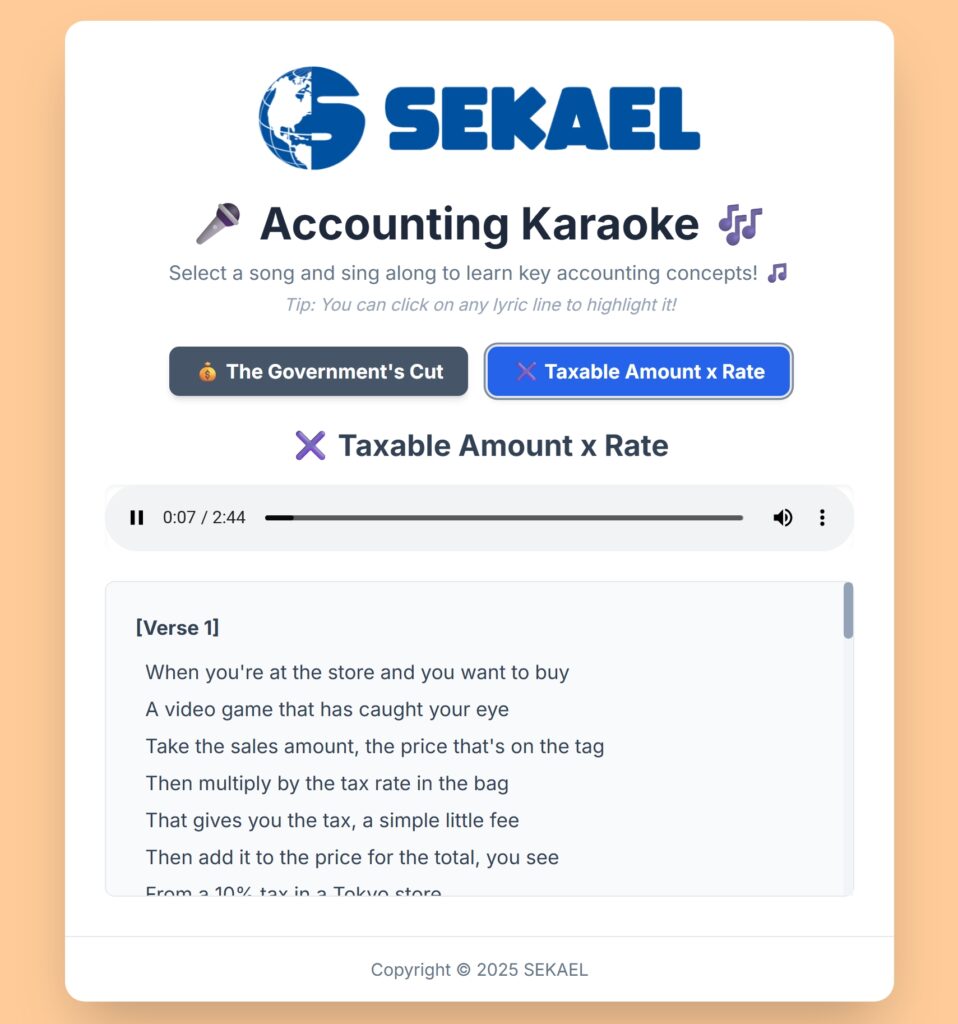

Listen to the Preview!

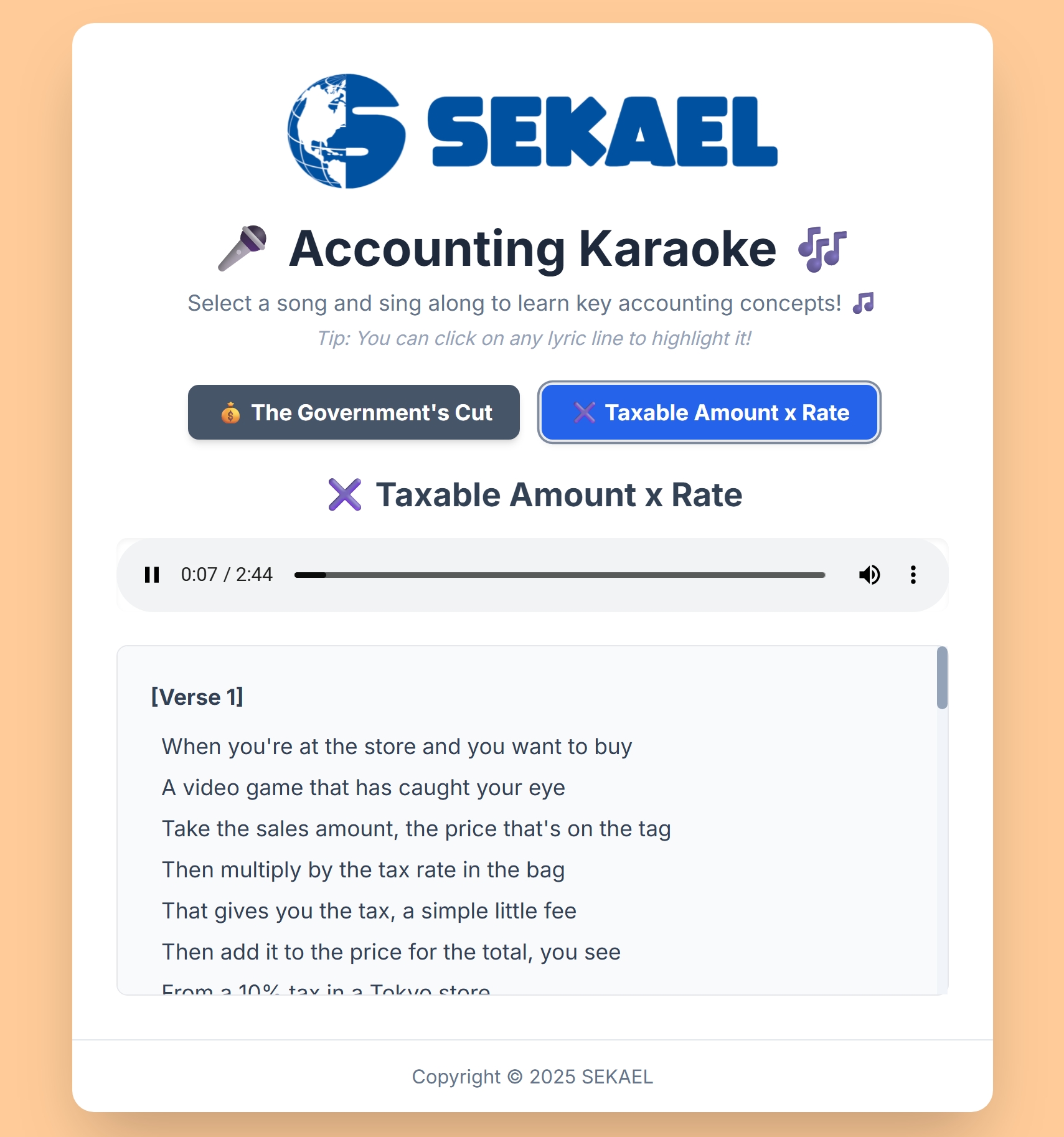

Accounting Karaoke System

What it is: An interactive web player with original songs that turn complex tax concepts into unforgettable anthems.

Unique point: Features the track “Taxable Amount Times the Rate,” which drills the single most important formula into your memory, so you never have to feel intimidated by tax math again.

Advantages: Makes learning financial principles fun and incredibly effective, helping you absorb the core rule of tax calculation without tedious memorization.

What you’ll learn: Through catchy lyrics, you’ll master the universal formula and learn key terms like Gross Pay, Net Pay, Consumption Tax, and Withholding.

The Smarter Way to Be Fearless in Accounting

Who We Are

At SEKAEL, we blend extensive experience in curriculum development with technical expertise to create uniquely effective learning tools. Our background includes creating over 20 lesson materials from scratch and training international professionals, giving us a deep understanding of how to make complex topics simple for a global audience. We combine this with in-house technical skills in developing interactive applications and games using HTML, CSS, and Javascript. This allows us to move beyond traditional documents and build the engaging karaoke and quiz systems you’ll find in this course. Our mission is to transform intimidating subjects into clear, memorable, and even fun experiences.

Your 14-Day Risk-Free Guarantee

Frequently Asked Questions

Absolutely. This course is designed specifically for you. We show you that all the complicated-sounding tax math boils down to one simple multiplication formula you already know.

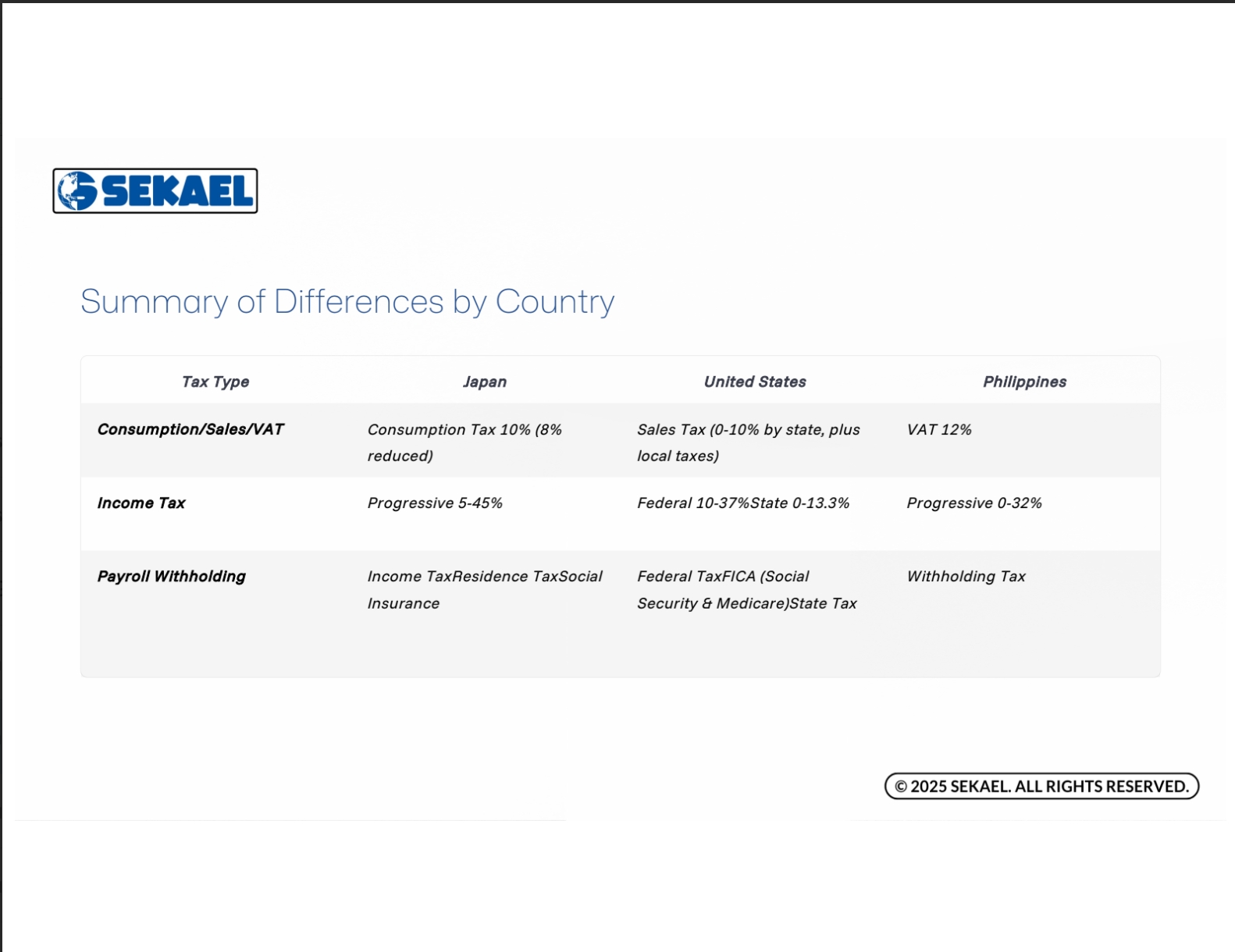

While our specific examples are for these three countries , the core principle-that all tax is calculated by Taxable Amount x Tax Rate4 – is a universal concept that will give you the confidence to tackle any tax system.

You will be able to calculate the total cost of a product with tax added, figure out the net (take-home) pay from a gross salary, and understand how to find the pre-tax price of a “tax-inclusive” item.

Yes, it’s a one-time payment of 12 USD for lifetime access to all materials.