Conquer Accounting's Most Confusing Step:

Create Perfect Journal Entries, Every Single Time.

Our systematic 4-step system turns transaction chaos into perfect,

balanced books – no accounting degree required.

Does Recording a Simple Transaction Feel Like an Impossible Puzzle?

- Are you staring at a transaction, completely stuck on the meaning of “Debit” and “Credit,” afraid that one wrong choice will throw your entire financial picture off balance?

-

- Do you worry about incorrectly calculating or recording taxes like the 12% Philippine VAT, potentially overstating your income and creating a hidden liability for your business?

-

- Does every transaction feel like a brand-new, chaotic problem because you lack a clear, repeatable checklist to follow from start to finish?

Imagine Recording Every Transaction with Total Confidence

Instantly know whether to debit or credit an account by following the simple rules and memory aids you’ll learn in our guide and interactive quizzes.

Confidently handle transactions with taxes using step-by-step calculation guides and interactive math problems that make it simple to find the correct numbers for sales, VAT, and payroll.

Turn every business event4from a client payment to a software purchase – into a simple, four-step process: Analyze, Identify, Apply Rules, and Record.

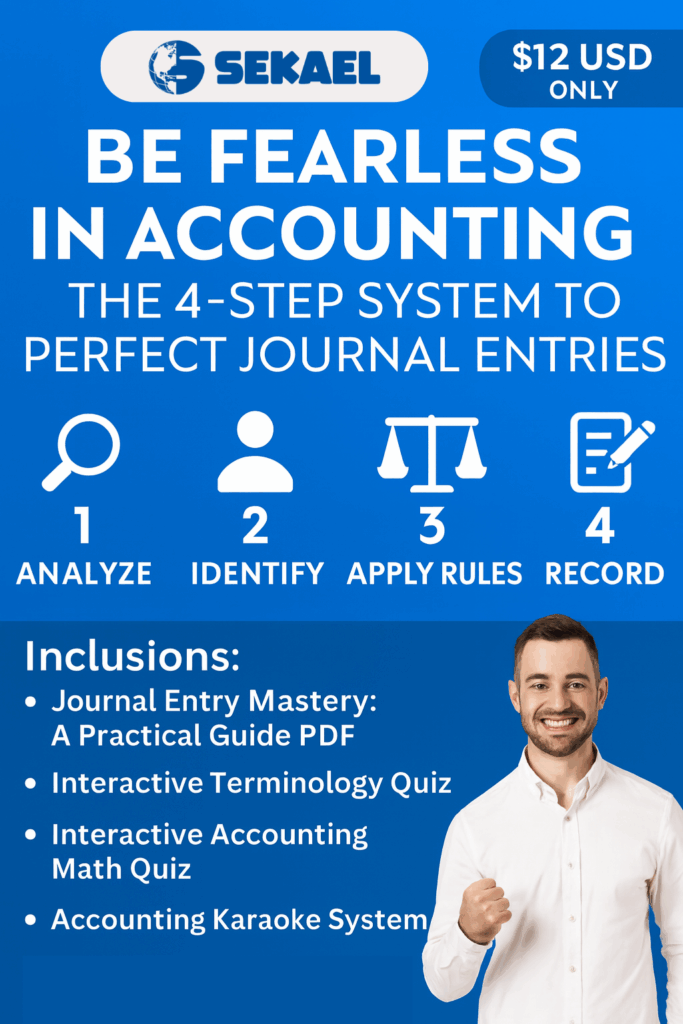

INTRODUCING

Be Fearless in Accounting:

The 4-

Step System to Perfect Journal

Entries by SEKAEL

- The definitive guide for creative professionals and freelancers to master the art of the journal entry.

-

- A step-by-step system designed to eliminate confusion and build unshakable confidence in your bookkeeping.

-

- Packed with practical examples, interactive tools, and unique learning methods to make accounting finally click.

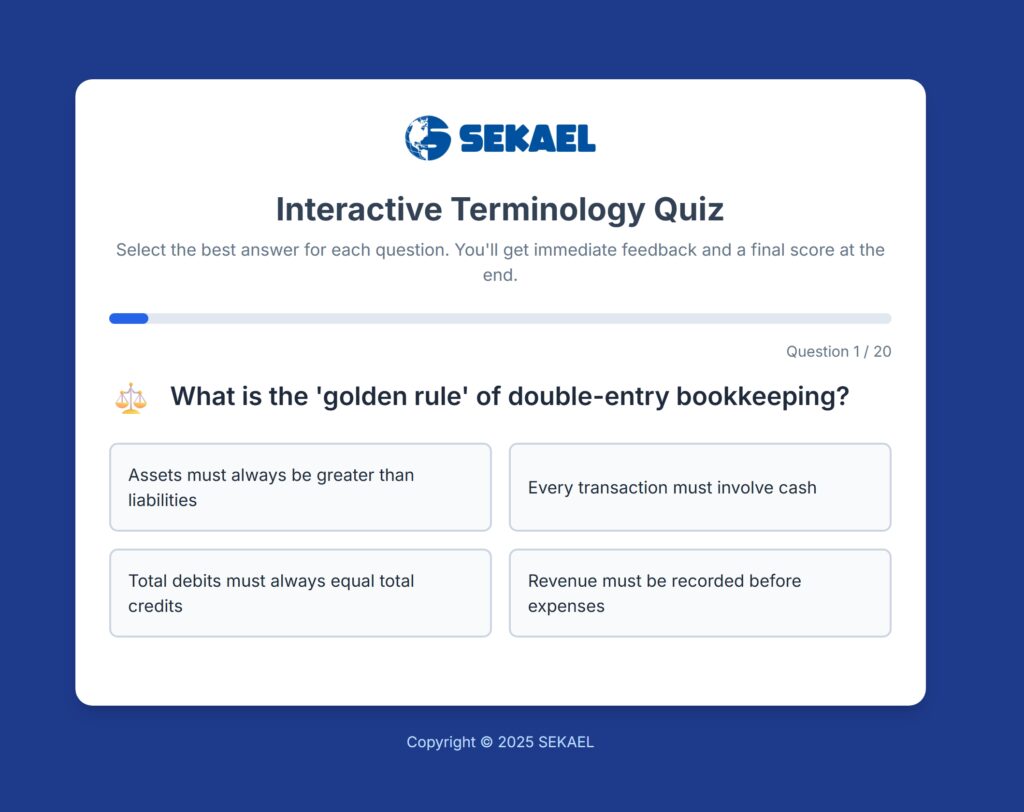

Interactive Accounting Terminology Quiz

What it is: A fun, interactive HTML quiz designed to test your knowledge of the 20 most essential accounting terms.

Unique point: Get immediate feedback and detailed explanations for

every single answer, helping you learn why a term means what it does.Advantages: This engaging format solidifies your understanding,

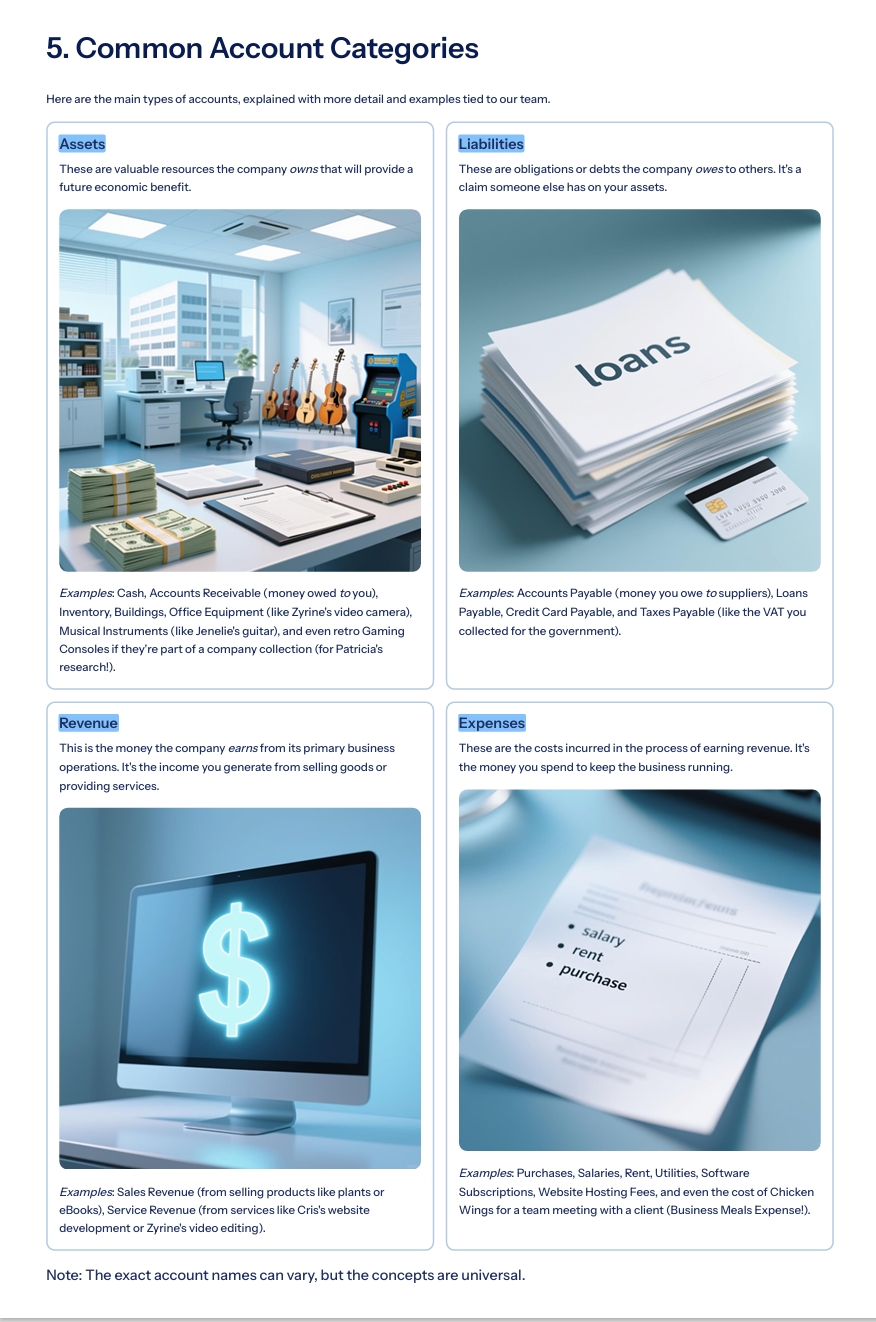

ensuring you never mix up “assets” and “liabilities” or the “golden rule” of debits and credits again.What you’ll learn: You will master the core language of accounting, from understanding the purpose of a journal entry to identifying different account types like Accounts Payable and Receivable.

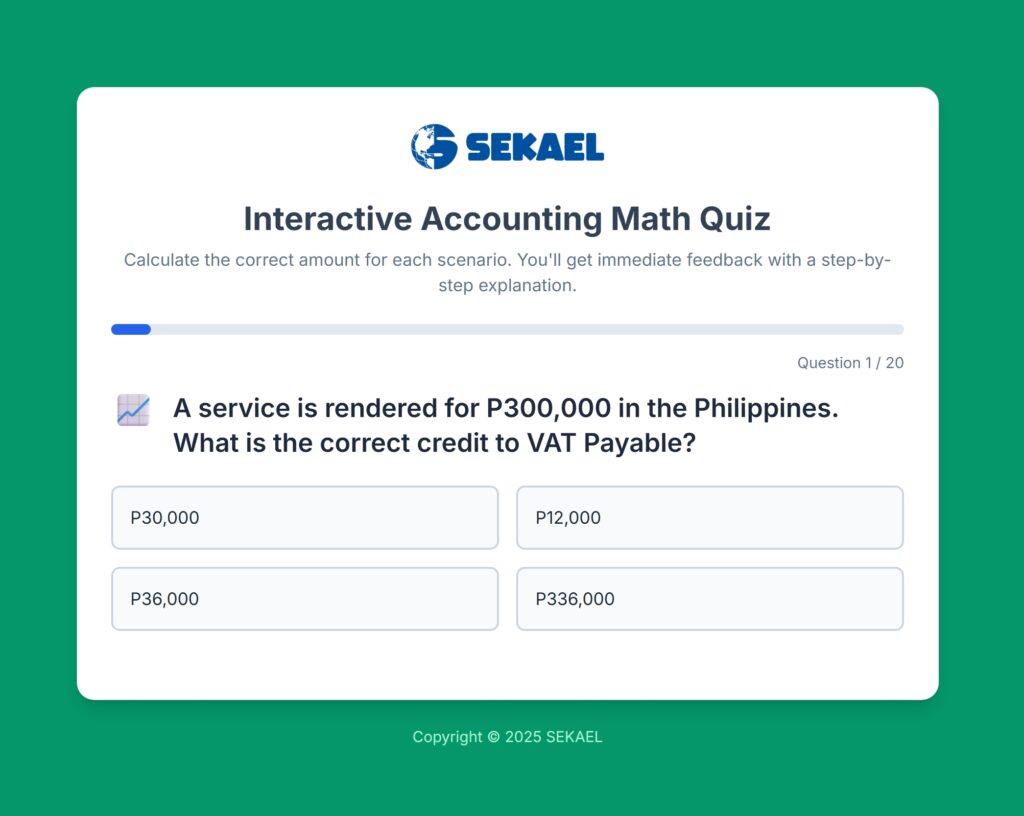

Interactive Accounting Math Quiz

What it is: An interactive HTML quiz that focuses entirely on the essential calculations you’ll face when making journal entries.

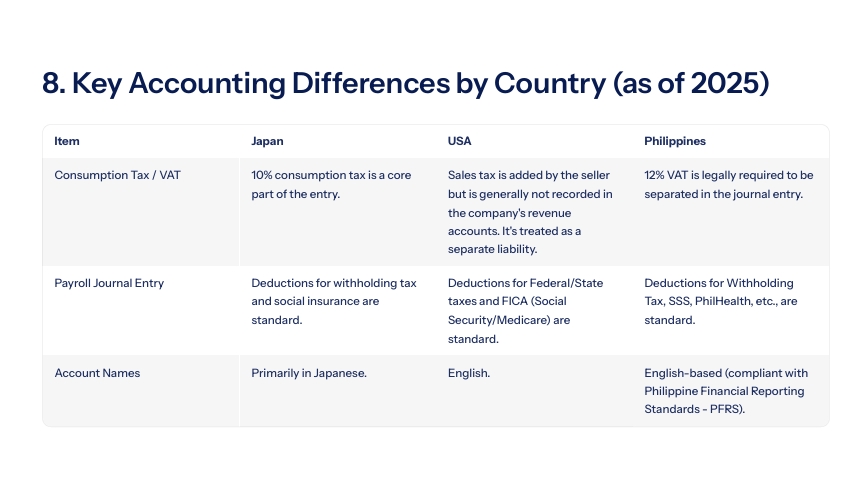

Unique point: It features practical, real-world scenarios for tax and payroll calculations, with a special focus on the rules for the Philippines and Japan.

Advantages: You can overcome any fear of math with step-by-step explanations that show you exactly how to calculate VAT, work backwards from a total, and handle payroll deductions.

What you’ll learn: You will learn how to accurately calculate 12% Philippine VAT, 10% Japanese Consumption Tax, and determine an employee’s net pay from their gross salary.

Listen to the Preview!

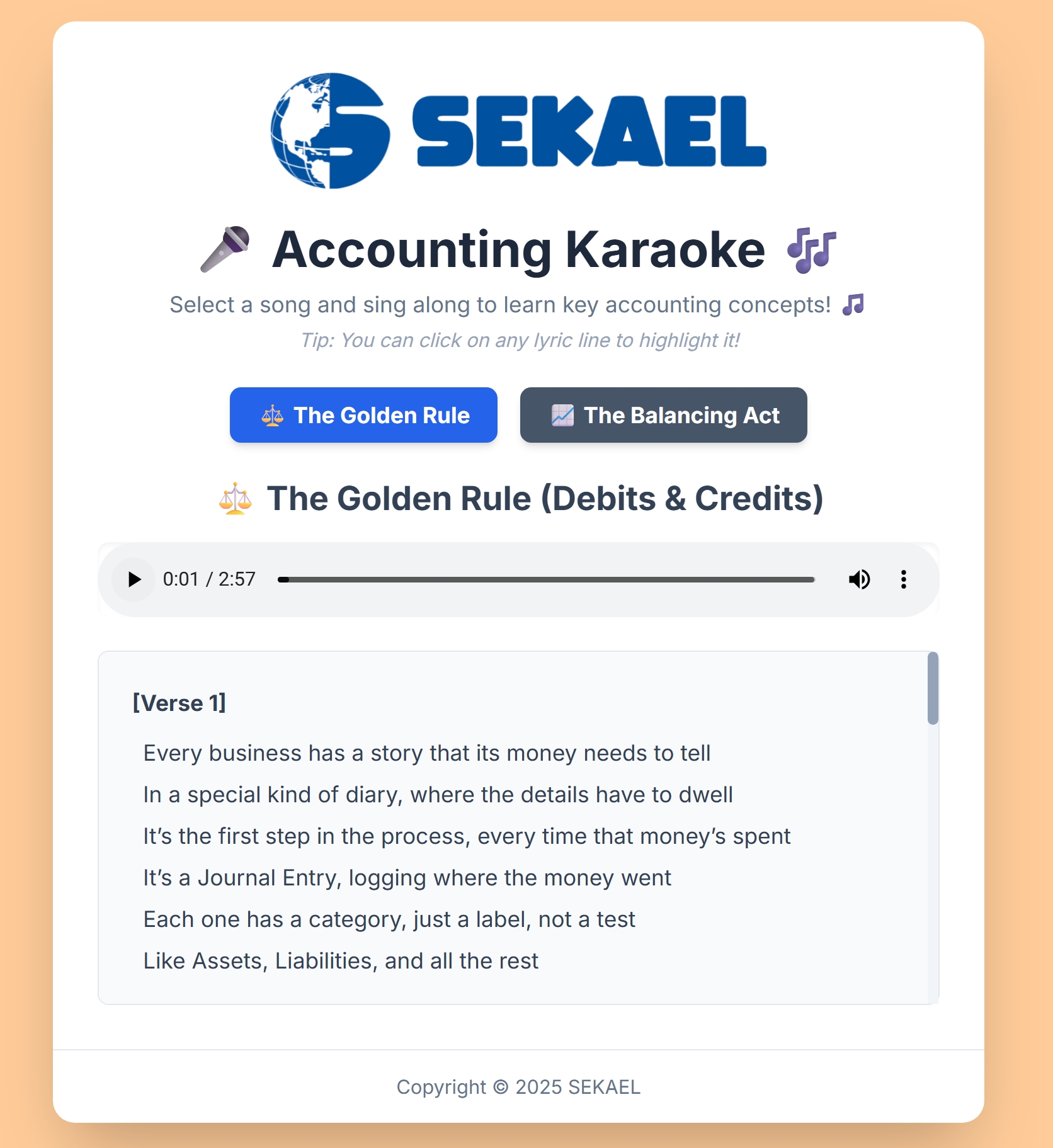

Accounting Karaoke System

What it is: A unique and memorable HTML-based audio learning tool

that teaches accounting concepts through two original songs.Unique point: This is an unconventional and fun way to learn accounting

rules – by singing along to catchy tunes about debits, credits, and balancing your books.Advantages: The memorable music and lyrics help burn the core principles of accounting into your memory, making it easier to recall the “Golden Rule” (Debits = Credits).

What you’ll learn: You will learn the fundamental rules of debits and credits and the math behind a balanced transaction, all through unforgettable lyrics and music.

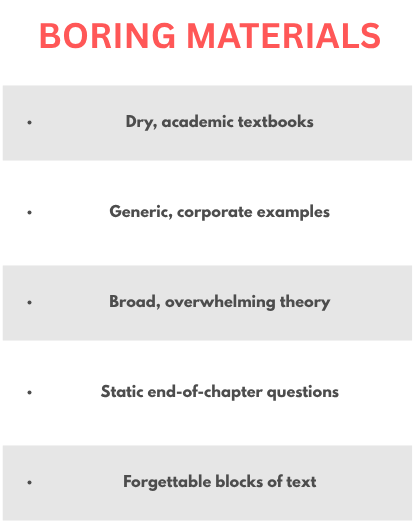

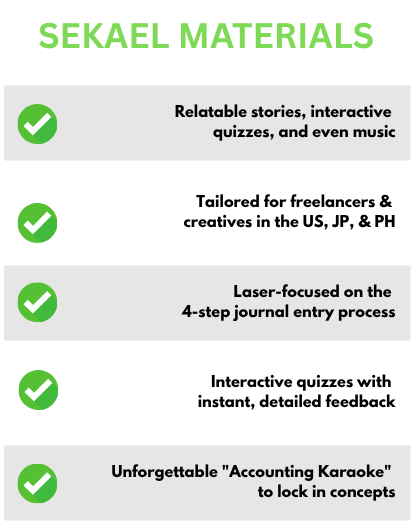

The Smarter Way to Be Fearless in Accounting

Who We Are

We are a team with extensive experience in curriculum and material development, skilled at creating entire courses from scratch and writing everything from teaching manuals to over 100 comic scripts explaining complex topics. Our background includes training international professionals from Vietnam, Indonesia, and Taiwan in essential business communication skills. We combine this instructional design experience with technical expertise in developing interactive learning materials using HTML, CSS, and Javascript. This allows us to deconstruct intimidating subjects like accounting into simple, engaging, and effective learning systems. We are passionate about creating tools that empower people to master new skills with confidence.

Refund Policy

Frequently Asked Questions

Yes! This system is designed specifically for those intimidated by

accounting. We start with the absolute basics, assuming you know

nothing.

No. The main guide is a standard PDF, and the interactive quizzes and karaoke system are HTML files that open in any web browser on any computer.

You can read the main guide in about an hour and use the interactive

tools at your own pace. The goal is mastery and confidence, not speed.

Absolutely. The core 4-step process and the “golden rule” of debits and credits are universal in accounting. The country-specific examples are an added bonus for those who work there.

Yes, perfectly. This system teaches you the fundamental 4-step process for recording any business transaction. Whether it’s payment from a client in Japan, a software subscription purchase in the US, or a local expense, you’ll learn the core skill to record it accurately, which is exactly what freelancers with diverse income streams need.