Master Basic Accounting Math: From Simple Sums to Real-World Profit

Build your confidence with a clear PDF lesson, challenging quizzes, practical problem sets, and memorable learning songs that make accounting math easy to learn!

Does This Sound Familiar?

This feeling is frustrating.

It makes you doubt your abilities and can hold you back from making confident financial decisions.

Now, Imagine a New, Confident You...

Now, picture yourself understanding accounting math with ease.

This is the transformation from fearing numbers to using them as a powerful tool.

INTRODUCING

Accounting Compass:

The Essentials of Accounting Math by SEKAEL

This isn’t just another math lesson. It’s a complete, four-part system designed to build your foundational knowledge and then immediately let you practice and test your skills in a practical, engaging way.

First, you master the fundamentals with a clear, step-by-step lesson. Then, you apply what you’ve learned with practice problems and interactive quizzes to build real, lasting confidence.

It’s the fastest, most practical way to go from feeling intimidated by numbers to confidently using them.

What's Inside

Here’s How You’ll Master the Essentials of Accounting Math:

10-Question Practice Problem Set (PDF)

Apply your knowledge with challenging word problems. You’ll solve practical scenarios like calculating a budget variance, determining the profit on a single sale, and calculating multi- step payroll with overtime. Every problem includes a detailed, step-by-step answer explanation.

Two Learning Reinforcement Songs

Memorize the core concepts effortlessly with the lyrics to two catchy songs written to help the rules stick in your mind.

One-Time Payment Only

Pay once and own all the materials forever. Revisit the lesson and quizzes anytime you need a refresher.

Here's Exactly What You'll Get

You get a comprehensive package of expertly-crafted learning

materials designed to work together to build lasting knowledge.

1. The Core Lesson: "The Building Blocks of Accounting Math" (PDF)

This foundational guide teaches you that all accounting is built on just four basic tools. You’ll learn not just how to calculate, but why you’re doing it.

Master Addition: Learn how it’s used to total expenses and combine sales revenue. See a real example of totaling a day’s expenses from a café trip in the Philippines.

Master Subtraction: Understand the classic profit formula (Revenue – Expenses = Profit) and how to calculate an employee’s take-home pay (Gross Pay – Deductions = Net Pay).

Master Multiplication: See how to calculate total revenue (Price Per Item × Number of Items Sold) , employee wages , and sales tax using a real-world California tax rate.

Master Division: Learn to find averages, per-unit costs, and the critical profit margin metric.

International Context: The lesson includes simplified payroll examples from the USA, Japan, and the Philippines, showing how the same math applies to different currencies and regulations.

2. Two Interactive Quizzes (Webpage Based)

Test your knowledge and get instant feedback with two dynamic quizzes that work on any computer, tablet, or smartphone.

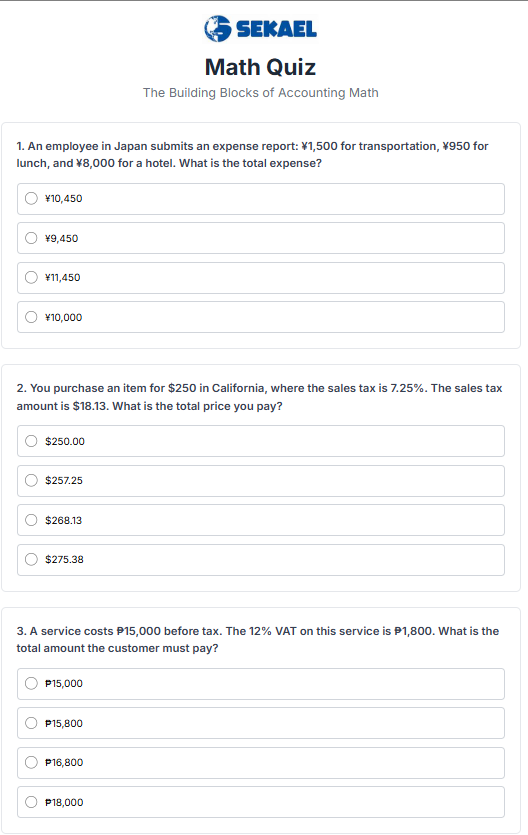

20-Question Math Quiz:

Solve 20 practical accounting math problems. You’ll be asked to calculate the total revenue for selling 500 product units, find the total overtime pay for a US employee earning $20/hour, and determine a company’s Earnings Per Share (EPS). After submitting, you get a detailed explanation for every single answer.

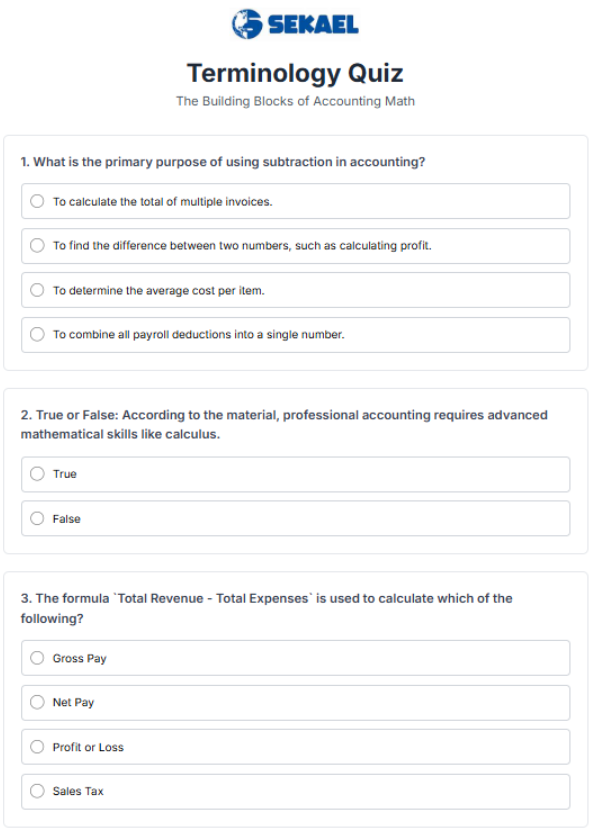

20-Question Terminology Quiz:

A strong vocabulary is crucial. This quiz tests your understanding of 20 key terms, including “Gross Pay” vs. “Net Pay”, “Favorable Budget Variance”, and what FICA funds in the USA. You’ll get immediate feedback showing the correct answers.

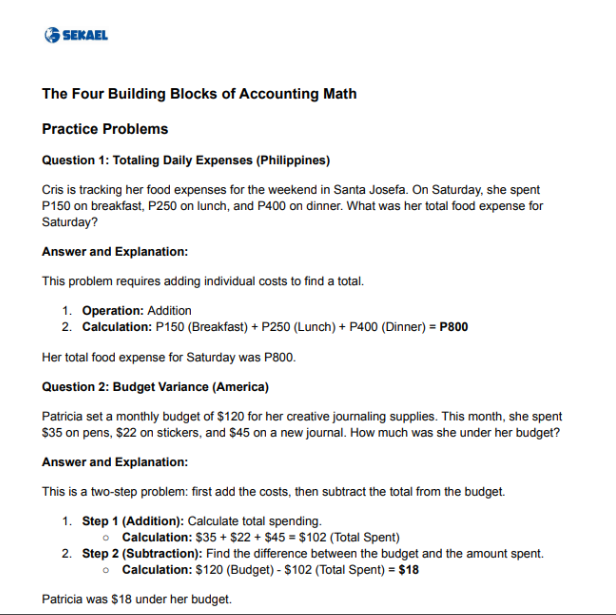

3. 10-Question Practice Problem Set (PDF)

Apply what you’ve learned with a dedicated worksheet of real-world business and personal finance scenarios.

Practical Scenarios:

You won’t just solve for ‘x’. You’ll calculate a monthly budget variance for creative supplies in America , figure out the profit on a custom-made tote bag , and determine an employee’s take-home pay after taxes and social contributions in the Philippines.

Multi-Step Challenges:

Tackle complex problems that require using several operations, such as calculating the total cost of a multi-item dinner bill and then splitting it evenly among 5 friends.

Step-by-Step Solutions:

Every single problem comes with a detailed answer key that breaks down the calculation, explaining which operation to use and why, so you can learn from your mistakes.

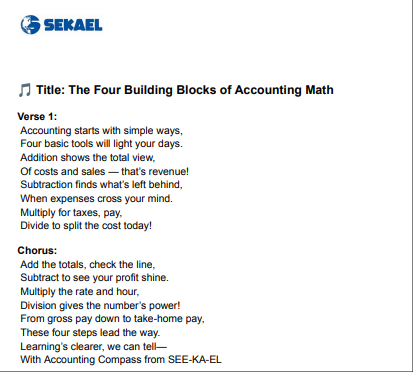

Two Learning Reinforcement Songs

(with Lyrics in PDF file)

Memorize the core concepts in a fun, unforgettable way.

Easy Memorization:

The lyrics are written to be catchy and simple, reinforcing the purpose of each math operation.

Concept-Rich Lyrics:

The songs explicitly mention key formulas and ideas from the lesson, with lines like, “Subtract to see your profit shine” , “Multiply the rate and hour” , and “From Tokyo, Cali, Manila’s way, The math of business saves the day”.

An Unbeatable Value to Launch Your Career

Hiring a private tutor or enrolling in a basic accounting course?

That could cost you hundreds of dollars and take weeks. We’ve bundled everything you need into one affordable, high-value package.

The Old Way

(Expensive & Slow)

• Method: Expensive textbooks or long, boring courses.

• Practice: Limited, abstract exercises with no immediate feedback.

• Schedule: Weeks or months of study on a rigid schedule.

• Access: Pay per lesson or semester. Limited access.

The SEKAEL Way

(Affordable & Fast)

Content: Get a comprehensive PDF lesson, a practice problem set, two interactive quizzes, and two learning songs.

Practice: Solve dozens of practical problems and get instant feedback with detailed explanations on every quiz question.

Schedule: Learn at your own pace. You can start in the next 5 minutes!

Access: One-Time Payment Only

This isn’t a “discount.”

It’s an opportunity to invest in your goals efficiently, affordably, and with an expert-designed system to guide you every step of the way.

Get Instant, Full Access to Everything

For Only $12

Frequently Asked Questions

Yes! This package is perfectly designed for anyone who feels intimidated by accounting math. The lesson starts with the absolute basics (addition, subtraction, multiplication, and division) and shows you exactly how they are used in business, step-by-step.

The core math concepts are universal , but to make them practical, the lesson and problems include specific, real- world examples from the USA, Japan, and the Philippines. This shows you how the same rules apply to different currencies, taxes, and payroll systems.

Immediately after your payment is processed, you will be directed to a page where you can download all the materials instantly.

You're At a Crossroads...

You can continue to let financial uncertainty and the fear of numbers hold you and your business back.

Or, for only $12, you can invest in yourself today and gain the skills, confidence, and knowledge you’ve been dreaming of.

The choice is yours.

Income Disclaimer

This product is for educational and informational purposes only. Although it provides details, strategies, and insights on specific accounting principles and practices, we do not guarantee any specific financial results or earnings.

Your success depends on various factors, including your individual effort, financial resources, experience, and market conditions. Past performance is not indicative of future results.

The information in these materials does not constitute professional accounting, legal, or other financial advice. We are not responsible for any losses or damages arising from the use of this information.

Always consult qualified professionals, such as a Certified Public Accountant, before making important financial decisions.

Do you have any questions?

We'd love to hear from you! Please fill out the form below and we will get back to you shortly.